The natural gas industry promotes Renewable Natural Gas (RNG) as its answer to a growing call for building electrification and ordinances prohibiting natural gas in new construction. RNG, which is the rebranding of biomethane, is captured methane from biogenic sources, such as decomposing organic material in landfills or animal manure. The American Gas Association (AGA) claims that RNG provides a pathway for gas utilities to reduce their carbon footprints by injecting the biomethane into gas pipelines and displacing fossil gas. RNG advocates further argue that capturing biogenic methane which would otherwise escape into the atmosphere and selling it to customers allows gas utilities to claim that their gas is carbon negative. (Burning the methane produces CO2, which is a less potent greenhouse gas, though it remains in the atmosphere longer.)

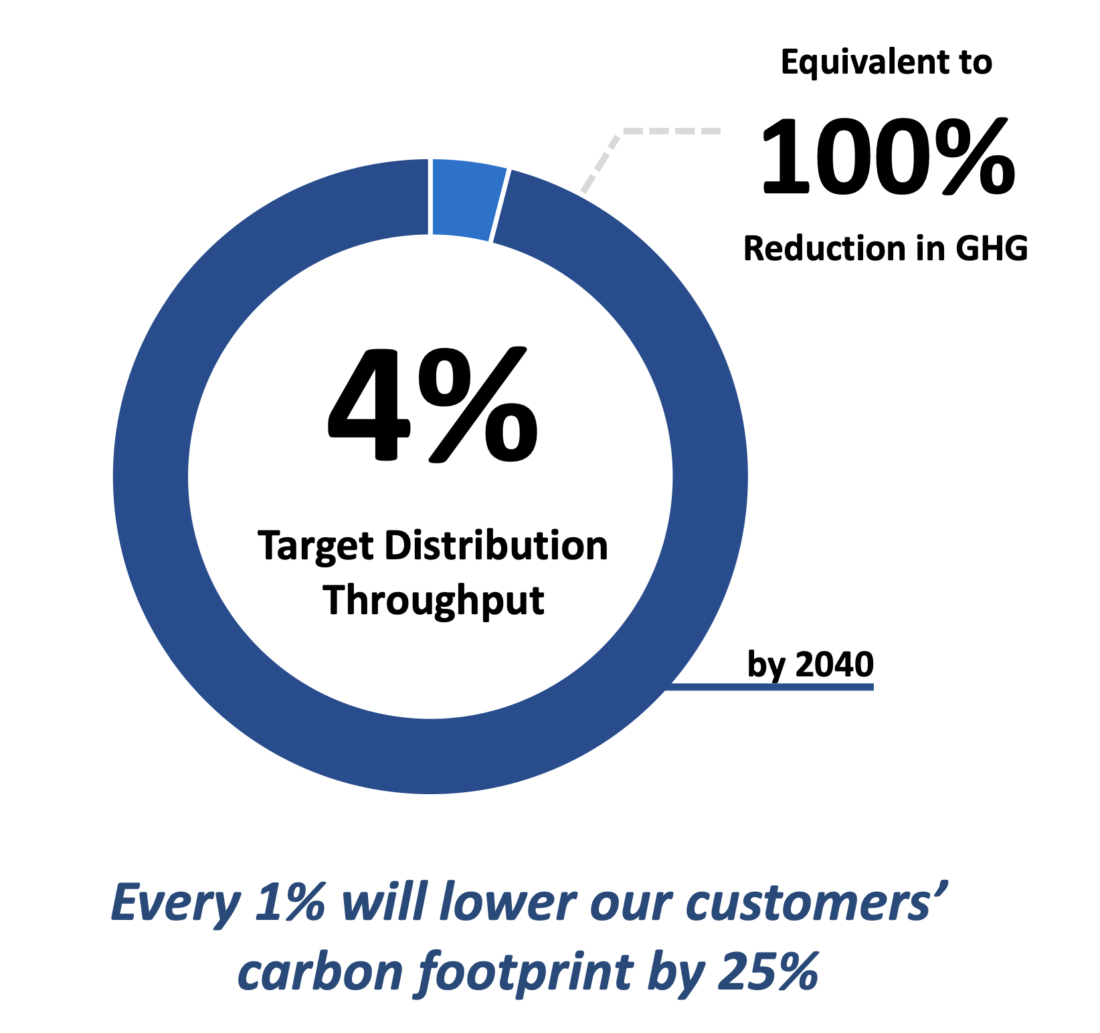

For example, Dominion Energy pledges that it will inject only 4% RNG by volume into its gas systems by 2040, but claims doing so will result in a 100% reduction in greenhouse gases. Dominion appears to assume that each percentage of RNG by volume contributes to a 25% reduction of net greenhouse gases, because methane is 25 times more potent than CO2. Injections rates vary by utility — SoCalGas pledges that it will inject 20% RNG into its system by 2030. No matter the injection rate, the vast majority of gas sold by these utilities would still be a fossil fuel.

RNG provides a convenient way for gas utilities to delay the pace of electrification, as well as a rationale for continued investments in gas infrastructure in the face of growing concerns about climate change from cities, states, regulators and many investors.

Not only is RNG displacing a small percentage of fossil gas, but it’s also considerably more expensive than natural gas and limited in supply. Instead of injecting the gas into the grid, many climate experts suggest that captured biomethane makes more sense to use for harder-to-electrify end uses such as construction equipment or heavy industry.

Documents: Industry experts question RNG

Even industry insiders are concerned about the costs and supply. Mark Krebs, an Energy Policy Specialist at St. Lous based Spire Energy, said in a message to other gas utility employees that he believes RNG “will not sustain our industry at its present size.”

Michael Boccadoro, a lobbyist for California’s dairy industry, told the Guardian US that “[RNG] doesn’t pencil out and it doesn’t make all that much sense from an environmental standpoint…It’s a pipe dream.”

Boccardo also raised concerns about the supply and price of RNG in a series of emails with fellow board members of Californians for Balanced Energy Solutions, a front group created by SoCalGas to oppose electrification. Matt Rahn, the Chairman of C4BES, played down Boccado’s concerns in an email to the entire board.

Boccadoro no longer serves on the board of C4BES.

RNG “to mitigate opposition’s fever”

An internal set of AGA meetings notes from March 2018 points to RNG advocacy as part of a strategy to blunt anti-gas advocates: “Consider how technologies to decarbonize the pipeline can serve as a conduit to environmental organizations, thereby seeking to mitigate the opposition’s fervor against infrastructure expansion.” The suggestion came during a presentation by National Grid, which has faced fierce opposition to new pipeline construction from the advocacy group Mothers Out Front.

American Gas Association’s Clean Energy Task Force developed draft policy principles for RNG in January of 2018. As stated in the document, AGA “supports policies that define the term “renewable energy” to include RNG on par with other included energy sources, such as energy generated from wind or solar resources.” The principles also discuss RNG as a way for gas to count towards Zero Net Energy standards for buildings.