This report documents the growing isolation of the coal mining industry, and lost member companies at the National Mining Association, American Coalition for Clean Coal Electricity, and World Coal Association.

By Joe Smyth, Climate Investigations Center

Report Published: August 2016

Download a PDF version of this report

Update 1: Two (or three?) more companies confirm departure from coal lobby group ACCCE

As efforts to address climate change gain momentum, there is growing consensus that transitioning away from coal is one of the most important steps available for rapid reductions of carbon pollution. Increased public awareness of coal’s contribution to dangerous levels of air pollution has also highlighted the broad benefits of a transition away coal. And amidst these concerns, low natural gas prices and the rapid growth of renewable energy have cut into coal’s market share in the United States; in 2015, coal accounted for about one third of US electricity generation, down from about half a decade ago. In light of this structural decline of the coal industry, major banks have curtailed financing for coal mining companies. Finally, the Obama administration, many state and local governments, and some major companies have pursued a wide variety of measures to address climate change, reduce air pollution, and promote renewable energy, which have increased these trends.

All these factors mean that the coal mining industry is increasingly isolated, and its goal of increasing coal production levels (or at least maintaining current levels) has become further at odds with other business sectors’ interests, particularly companies that have committed to reduce their own carbon footprint, power their operations with 100% renewable energy for their operations, and/or publicly support national and global policy efforts to address climate change.

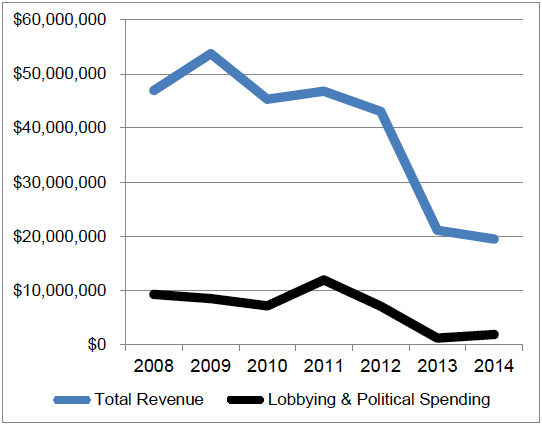

This growing isolation is reflected in the declining lobbying spending of the US coal industry’s principal lobby groups, the National Mining Association (NMA) and the American Coalition for Clean Coal Electricity (ACCCE). Both lobby groups have reduced lobbying spending in recent years, with a Bloomberg Government analysis showing that in 2015, ACCCE “cut its lobbying spending by 51 percent from 2014, while the National Mining Association cut back 44 percent.” A review of ACCCE’s Internal Revenue Service filings from 2008 through 2014 shows that this recent drop continues a longer trend of sharply decreased lobbying spending: ACCCE’s 2014 lobbying and political spending of $1.8 million was less than one-tenth of the $11.9 million it spent at its peak in 2011.

ACCCE’s declining revenue and spending, 2008–2014

| Year | Total Revenue | Lobbying & Political Spending |

| 2008 | $46,960,008 | $9,275,916 |

| 2009 | $53,733,277 | $8,452,051 |

| 2010 | $45,307,620 | $7,134,981 |

| 2011 | $46,799,601 | $11,923,457 |

| 2012 | $43,052,275 | $7,078,150 |

| 2013 | $21,106,956 | $1,180,444 |

| 2014 | $19,481,812 | $1,868,135 |

Source: ACCCE 990 IRS filings, 2008-2014

Moreover, ACCCE and NMA have both lost major member companies in recent years because those companies opposed the coal lobby groups’ attacks on policies aimed at addressing climate change. Some of those departures have gained public attention. During the debate around the 2009 Waxman-Markey climate bill, Duke Energy left ACCCE and explained at the time that “we believe ACCCE is constrained by influential member companies who will not support passing climate change legislation in 2009 or 2010.” More recently, during the Paris climate summit in December 2015, Volvo left NMA, calling its efforts against the Clean Power Plan “crazy.”

However, several other companies that were once listed as members of ACCCE and NMA have disappeared from each lobby group’s membership lists, sometimes without public notice or explanation. Climate Investigations Center surveyed more than twenty companies that have been removed from NMA and ACCCE’s membership list web pages. We requested confirmation that the company had ended its membership, as well as the date and reason for the company’s departure. This report shows the results of that survey, including responses from each company that confirmed its departure from ACCCE or NMA. Because some companies did not respond to the survey, we use the Internet Archive Wayback Machine to show the time frame in which each company was removed from the NMA or ACCCE membership list web pages. We also sought explanations from five major companies for their departures from the World Coal Association, a global lobby group for the coal industry based in London.

Survey responses revealed that over the past two years, ACCCE has lost two more utility companies that were once major funders of the coal lobby group: Ameren and DTE Energy. DTE Energy explained that “ACCCE no longer aligns with our business strategy.” Two other major ACCCE funders, Consol Energy and bankrupt Arch Coal, are also no longer listed on ACCCE’s membership list web page, although they did not confirm whether they had departed from ACCCE. Along with earlier membership losses, seven of the twelve companies that gave $1 million or more to ACCCE in 2008 are now missing from ACCCE’s membership list. In addition, only two of the seven utility companies that were major ACCCE funders in 2008 remain members today: American Electric Power and Southern Company.

The National Mining Association has also lost several major member companies in recent years: Anglo American, Chevron, Pacificorp, Wells Fargo, and Zurich each confirmed their departures from NMA, along with public departures from Volvo and SKF. Chevron and Anglo American both highlighted their decisions to exit the coal mining industry, while Zurich explained its departure as a cost cutting measure. Five other major companies have also recently been removed from NMA’s membership list web page: KPMG, Wood Mackenzie, Michelin, CSX, and Norfolk Southern. Those companies did not confirm whether they had departed from NMA.

The World Coal Association’s annual reports show that it has also recently lost major member companies, including companies that did not offer an explanation for their disappearance from ACCCE or NMA membership lists: Consol Energy, GE, and bankrupt Arch Coal. Another bankrupt US coal mining company, Alpha Natural Resources, also ended its WCA membership, and the timing suggests that both companies ended their memberships because of their bankruptcies. In contrast, bankrupt Peabody Energy remains listed as a member of all three coal lobby groups. Total S.A., the French oil and gas supermajor, departed from WCA, stating that “it can be explained by the fact that we decided last year to exit the coal business.”

Company responses to Climate Investigations Center’s survey, along with a review of public statements, show a variety of stated reasons for company departures from ACCCE, NMA, and WCA. Some companies disagreed with the coal lobby groups’ efforts against climate policies. Other companies dropped their memberships as a part of their regular reviews of their trade group memberships, which suggests that the companies no longer consider the coal lobby groups worth their financial support. Finally, some companies that left ACCCE, NMA, or WCA pointed to their own shift away from coal. Companies in a variety of sectors presented this reason, including oil and gas, diversified mining, and utilities, signaling that it isn’t just coal lobbying efforts that have become increasingly isolated; it is the coal mining industry itself.

The American Coalition for Clean Coal Electricity (ACCCE) was formed in 2008 from two predecessor organizations, “Americans for Balanced Energy Choices” and the “Center for Energy and Economic Development.” Tax filings obtained by Greenwire show which companies contributed the bulk of ACCCE’s funding in its first year: Peabody Energy, Arch Coal, and Consol Energy each provided $5 million, Foundation Coal Corp. (which was acquired by Alpha Natural Resources in 2009) provided $3 million, Southern Company provided $2.1 million, American Electric Power, Duke Energy, and FirstEnergy each provided $2 million, Joy Global provided $1.985 million, and Ameren, DTE Energy, and Progress Energy each provided $1 million. The American Association of Railroads also provided $6 million, and its major members including BNSF, CSX, Norfolk Southern, and Union Pacific, are listed as members of ACCCE.

Soon after its founding, ACCCE was embroiled in controversy after one of its contractors sent fraudulent letters opposing the Waxman-Markey climate bill. The letters were mocked up on letterhead that looked to be from veterans, women’s, and civil rights groups, but were actually written and sent to several members of Congress by an ACCCE contractor without those groups’ permission or knowledge. Although ACCCE was informed of the fraudulent letters two days before the vote on the climate bill, members of Congress were not informed that the letters they received were faked until weeks later.

Even after these efforts to stop the Waxman-Markey climate bill using fraudulent letters came to light, ACCCE provided misleading information about its position on the climate bill. An article on September 9, 2009 noted in a clarification: “This story was changed to state that ACCCE opposed Waxman-Markey. An ACCCE spokeswoman in an interview Wednesday said that ACCCE was not opposed to Waxman-Markey but later in the day said that was an error and ACCCE at the time of the vote opposed the bill.” Yet more than a month later, ACCCE’s then-CEO, Stephen Miller, claimed in testimony to a Congressional hearing that ACCCE “never opposed the Waxman-Markey bill,” raising questions about whether he had lied under oath.

ACCCE’s inconsistent representation of its position on the climate bill may have been connected to the conflicting and sometimes contradictory goals of its member companies and board of directors. Those differences erupted into public view when Duke Energy, one of ACCCE’s biggest funders in 2008, announced in September 2009 that it had left ACCCE. Duke Energy pointed to “influential member companies who will not support passing climate change legislation in 2009 or 2010,” without naming specific member companies. Soon after Duke Energy’s departure, aluminum manufacturer Alcoa acknowledged that it too had recently left ACCCE, pointing to company-wide effort to reduce costs. Then Alstom, the major global rail company based in France, announced that “We have resigned from ACCCE because of questions that have been raised about ACCCE’s support for climate legislation.”

A review of ACCCE’s membership list web page shows that another major global company, mining company BHP Billiton, also may have left the lobby group in this period between June 11, 2009 and December 18, 2009. BHP Billiton did not confirm to Climate Investigation Center if it had left ACCCE, or provide a reason for the possible departure.

The following year, Progress Energy also confirmed in March 2010 that it ended its membership in ACCCE, the second company to leave which had paid $1 million or more to the lobby group in its initial year.

Another major utility company, Germany-based E.ON, was removed from ACCCE’s membership list web page between August 12, 2011 and October 26, 2011. E.ON confirmed to Climate Investigations Center that it is not currently a member of ACCCE, and noted that E.ON is spinning off its coal and gas related business into a separate entity.

FirstEnergy, another electric utility and major funder of ACCCE (providing $2 million in 2008), was removed from ACCCE’s membership list web page between September 28, 2012 and October 5, 2012. FirstEnergy confirmed to Climate Investigations Center that it has not been a member of ACCCE since 2012, explaining its departure as “a business decision.”

GE Mining, a subsidiary of GE, was also removed from ACCCE’s membership list web page in 2012, between April 22, 2012 and April 27, 2012. GE confirmed that it is no longer a member of ACCCE, but did not provide an explanation for its departure to Climate Investigations Center. However, as other companies were departing the lobby group in 2009, a GE spokesperson said that “ACCCE doesn’t reflect our view on climate legislation,” and that GE was “looking at our membership in ACCCE on a regular basis. If it’s not in the best interest of shareholders for us to be a member, then we won’t be a member.”

Despite the departures of several member companies that disagreed with its position on climate change policy, ACCCE’s membership and positions continue to demonstrate major inconsistencies and contradictions, including on some of the most critical questions facing the coal industry: climate science, and the viability and cost of carbon capture and sequestration (CCS) for coal-fired power plants.

In its first year, ACCCE touted carbon capture and sequestration as viable and affordable. An ACCCE press release in December 2008 touted “a list of more than 80 carbon capture and storage demonstration and research projects, predominantly underway in the U.S., proving again that the coal-based electricity sector is moving aggressively towards bringing advanced clean coal technologies to the marketplace domestically and abroad.” In 2009 ACCCE’s website proclaimed that “The technology isn’t 20 years away — some of it is here today. There have already been technology demonstrations of greenhouse gas emissions control for existing power plants,” and promised “that coal will remain a low-cost energy option in the future even considering the cost of new technologies to capture and store CO2 – a common greenhouse gas.”

But in 2014 as the EPA considered rules to require new coal plants to use CCS, ACCCE argued just the opposite. In comments to the EPA on its New Source Performance Standards for Greenhouse Gas Emissions from New Fossil Fueled Electric Utility Generating Units, ACCCE said that “CCS is an emerging and unproven technology” and that “CCS is exorbitantly costly.”

These contradictions about the viability of CCS are also apparent within ACCCE’s member companies. Southern Company, a major funder of ACCCE in its first year and one of the only utilities still listed as an ACCCE member, has received hundreds of millions of dollars in federal subsidies for its Kemper Project in Mississippi. In contrast, other ACCCE members have opposed any measures aimed at reducing carbon pollution, including CCS – a spokesperson for Murray Energy, another ACCCE member, said that “The government has already spent substantially on carbon capture and storage (“CCS”) technology, and we have not made progress. The promise of CCS technology is used by politicians to pretend that they are doing something for the coal industry, when they are not.”

These contradictions are also apparent in the way that ACCCE members approach broader questions about climate policies and climate science. Southern Company and other utilities have sought to influence climate and energy policies toward providing federal subsidies for CCS projects, among other measures that would support their particular energy mixes and business strategies. Other ACCCE members, such as Peabody Energy and other coal mining companies, have been more focused on opposing any climate policy efforts, perhaps assuming that any serious effort to reduce carbon pollution would mean sharply lowered demand for coal. Recent bankruptcy filings show that each of the three largest US coal producers, Peabody Energy, Arch Coal, and Alpha Natural Resources, have also funded climate denial organizations.

ACCCE itself has also promoted climate denial talking points, including prominently in a 2014 reporttitled “The Social Costs of Carbon? No, the Social Benefits of Carbon.” This ACCCE report repeated fringe climate denial talking points that “the more CO2 there is in the air, the better plants grow,” and “Atmospheric CO2 enrichment generally tends to enhance growth and improve plant functions.” These claims recall old climate denial efforts by the fossil fuel industry in the 1990s, such asthe “Greening Earth Society,” but are rarely seen in 2014.

These climate denial claims are particularly confusing in light of ACCCE’s efforts to push for increased federal subsidies for CCS. Despite ACCCE’s contradictory statements on the viability and costs of CCS, ACCCE supports increased federal subsidies for CCS, calling for “investments that will bring the next generation of advanced clean coal technologies to the marketplace to further reduce emissions – including the capture and safe storage of CO2 emissions.” These comments beg the question: why would ACCCE push for CCS subsidies if it believes that “CO2 benefits exceed any estimates of CO2 costs,” as the ACCCE report claims?

ACCCE’s CEO and President Mike Duncan has struggled to explain these contradictions. When a reporter asked Duncan, in light of his comments promoting CCS, if he believed that burning coal contributes to climate change, Duncan first tried to avoid answering directly, and then stated: “I’m not answering your question.”

Over the last eighteen months, another eight members, both companies and electric cooperatives, have been removed from ACCCE’s membership list web page, including four of the twelve companies that gave ACCCE $1 million or more in 2008: DTE Energy, Ameren, Arch Coal, and Consol Energy.

Two Michigan-based utilities, DTE Energy and Consumers Energy, were removed from ACCCE’s membership list web page between March 15, 2015 and April 16, 2015. DTE Energy responded to Climate Investigations Center to confirm, stating: “With the transition of DTE’s energy generation resources to a more diversified fuel base, ACCCE no longer aligns with our business strategy and we are no longer affiliated. ACCCE was notified in January 2015.” DTE Energy paid $1 million to ACCCE in 2008, according to tax filings obtained by Greenwire, making it one of twelve companies that paid $1 million or more to ACCCE in its first year. Consumers Energy did not confirm whether it had ended its membership with ACCCE, or provide an explanation to Climate Investigations Center

More recently, Ameren, Arch Coal, and Consol Energy were each removed from ACCCE’s membership list web page between September 24, 2015 and March 12, 2016. Ameren, a utility company based in Missouri, responded to Climate Investigations Center to confirm, stating: “Yes, we ended our membership at the end of 2015 as part of our routine assessment of our membership associations and related costs.” Ameren paid $1 million to ACCCE in 2008, according to tax filings obtained by Greenwire, making it one of twelve companies that paid $1 million or more to ACCCE in its first year.

Arch Coal and Consol Energy did not confirm whether they had ended their memberships with ACCCE, or provide an explanation to Climate Investigations Center. Arch and Consol’s departure would represent the loss of two of ACCCE’s three biggest initial supporters – both companies gave $5 million to ACCCE in 2008, a figure matched only by Peabody Energy, according to tax filings obtained by Greenwire. As discussed below, Arch Coal’s possible departure from ACCCE may be linked to its bankruptcy. In contrast, Consol Energy’s possible departure may be linked to the company’s decision to transition away from coal mining toward natural gas extraction. While many US coal mining companies have remained entirely focused on coal extraction, in recent years Consol Energy has sought to largely shift its operations away from coal, selling some coal mines and spinning off othersinto a Master Limited Partnership. Consol Energy’s 2013 Corporate Social Responsibility Report summarized the reason for this strategy.

Adoption of comprehensive legislation or regulation focusing on greenhouse gas (GHG) reductions for the U.S. or other countries where we sell coal may make it more costly and less attractive to operate fossil fuel fired (especially coal-fired) electric power generation plants. Depending on the nature of the regulation, natural gas-fired power generation could become more economically attractive than coal-fired power generation, substantially increasing the demand for natural gas. CONSOL Energy’s strategy for the future, one based on increasing natural gas production, is further strengthened by any such GHG regulation.

Indeed, the shift away from coal that Consol Energy identified as a key risk for its coal mining operations is the same trend at the core of DTE Energy’s explanation – “the transition of DTE’s energy generation resources to a more diversified fuel base” – for why ACCCE “no longer aligns with our business strategy.” Like many US utilities, DTE Energy has moved to shut down several of its coal-fired power plants.

With these more recent departures, seven of the twelve companies that gave $1 million or more to ACCCE in its first year are no longer listed as ACCCE members. Five of those companies have confirmed their departure from ACCCE, all major utility companies: Duke Energy, FirstEnergy, Ameren, DTE Energy, and Progress Energy. Two of those companies, Consol Energy and Arch Coal, have not confirmed whether they have ended their memberships in ACCCE. Only two of the seven utility companies that were major ACCCE funders in 2008 remain members today: American Electric Power and Southern Company.

Southern Company provided $100,000 to ACCCE in 2015 specifically for lobbying-related activities, while American Electric Power provided $20,000 to ACCCE in 2015 for lobbying. Neither company responded to Climate Investigations Center’s questions about their involvement with ACCCE, including the total amounts of their funding to ACCCE in 2015. American Electric Power noted in its 2016 reportto the Carbon Disclosure Project that “AEP remains a funding member of ACCCE, but reduced its membership level in 2015.”

The reality of climate change science, the impacts of policy measures to reduce carbon pollution, and the viability of carbon capture and sequestration in those efforts are surely among the most critical questions facing the coal industry. Yet ACCCE’s approach to these issues reflects the incoherence of the broader coal industry’s engagement in the climate policy debate – sometimes extolling the benefits of CCS, while at other times arguing that CCS is not viable and “exorbitantly expensive” – and at still other times, denying the reality of climate change or even claiming there are “benefits” of increased carbon pollution.

Five of those companies, all major utility companies, have confirmed their departure

| Company | Funding of ACCCE In 2008 |

Current ACCCE Member? |

Details of ACCCE membership status |

| Assoc. of American Railroads | $6 million | — | AAR companies remain listed as ACCCE members |

| Arch Coal | $5 million | ? | Removed from ACCCE member list in 2015/16 |

| Consol Energy | $5 million | ? | Removed from ACCCE member list in 2015/16 |

| Peabody Energy | $5 million | Yes | Remains listed as ACCCE member |

| Foundation Coal | $3 million | Yes* | *Acquired by Alpha Natural Resources, which remains |

| Southern Company | $2.1 million | Yes | Remains listed as ACCCE member |

| American Electric Power | $2 million | Yes | Remains listed as ACCCE member |

| Duke Energy | $2 million | No | Ended ACCCE membership in September 2009 |

| FirstEnergy | $2 million | No | Ended ACCCE membership after 2012 |

| Joy Global | $1.985 million | Yes | Remains listed as ACCCE member |

| Ameren | $1 million | No | Ended ACCCE membership at the end of 2015 |

| DTE Energy | $1 million | No | Ended ACCCE membership in January 2015 |

| Progress Energy | $1 million | No | Ended ACCCE membership in March 2010 |

Sources: Greenwire, November 18, 2009, “IRS disclosures show extent of oil and coal groups’ outreach“

Climate Investigations Center 2016 survey of companies no longer listed as ACCCE members

Six electric cooperatives have been removed from ACCCE’s membership list web page

Six electric cooperatives have also been removed from ACCCE’s membership list web page, including three within the last year. Climate Investigations Center’s survey did not request confirmation or explanation from these electric cooperatives.

Electric Cooperatives of Arkansas was removed from ACCCE’s membership list web page between September 24, 2015 and March 12, 2016.

Basin Electric Power Cooperative was removed from ACCCE’s membership list web page between September 24, 2015 and March 12, 2016.

Sunflower Electric Corporation was removed from ACCCE’s membership list web page between September 24, 2015 and March 12, 2016.

Associated Electric Cooperative was removed from ACCCE’s membership list web page between December 18, 2009 and February 13, 2010.

Seminole Electric Cooperative was removed from ACCCE’s membership list web page between June 11, 2009 and December 18, 2009.

Western Farmers Electric Cooperative was removed from ACCCE’s membership list web page between June 11, 2009 and December 18, 2009.

The National Mining Association (NMA) represents coal mining companies, and seeks to block climate policies, as well as clean air and water rules, workplace safety rules, and other measures that the lobby group believes would restrict coal extraction. NMA has sued to block the Clean Power Plan, published a flawed report about its costs and benefits, and urged Congress to block the Plan. NMA CEO Hal Quinn has also called on governors not to comply with the Clean Power Plan, and NMA spokesman Luke Popovich said that President Obama’s global climate efforts mean that “The president is on the wrong side of history.”

Like ACCCE, NMA’s efforts against climate policies have sometimes promoted climate denial talking points. For example, NMA’s official comments on the Environmental Protection Agency’s Endangerment Finding, which determined that greenhouse gases present a threat to public health and welfare, include several paragraphs questioning basic climate change science, such as complaints that the finding “does not address at all the significant scientific evidence that calls into question whether observed variations in the Earth’s climate are natural or man-made,” and: “The problem with the AGW [Anthropogenic Global Warming] theory is that one or more of EPA’s assumptions about its computer models may be severely flawed.”

The Guide for Responsible Corporate Engagement in Climate Policy, a report by the United Nations Global Compact and other organizations, considers the NMA a group that has failed to “accept basic climate science as the foundation for discussion of climate change policy.” Influence Map, which grades companies’ and trade associations’ lobbying on climate policies, gives NMA an “F.”

Beyond climate policy efforts, NMA also opposes the Interior Department’s Stream Protection Rule, as well as its efforts to reform the Federal Coal Program. NMA has also promoted controversial coal export terminals in the Pacific Northwest. NMA’s efforts extend to workplace safety issues, such as its lawsuit against Mine Safety and Health Administration rules to protect coal miners from black lung.

NMA’s membership includes coal and other mining companies, as well as companies that do business with mining companies such as mining equipment manufacturers and financial and consulting firms. Five major companies responded to Climate Investigations Center’s survey to confirm that they had departed the lobby group in recent years: Anglo American, Chevron, Pacificorp, Wells Fargo, and Zurich. Volvo and SKF also publicly confirmed in December 2015 that they left NMA, pointing to disagreements with the coal lobby group’s efforts against climate policies. Below are details about each company’s departure from NMA, including the apparent time frame and any explanation provided in response to Climate Investigations Center’s survey.

Anglo American

Anglo American Exploration (USA) Inc., a subsidiary of global mining company Anglo American, was removed from the National Mining Association’s membership list web page between February 9, 2016and March 24, 2016. Anglo American responded to Climate Investigations Center to “confirm that Anglo American cancelled its membership with NMA in February of this year due to a combination of reasons including budget constraints. You may also recall that in February this year we announced we will exit the coal business.” Anglo American also pointed to its position on climate change.

Chevron

Chevron Mining Inc., a subsidiary of Chevron, was removed from the National Mining Association’s membership list web page between June 25, 2014 and February 15, 2015. Chevron responded to Climate Investigations Center, noting, “Chevron Mining Inc. (CMI) ended its membership in NMA in 2014, which coincided with the closure of the Chevron Questa Mine in June of that year. Chevron no longer has active coal or mineral mining operations.”

Pacificorp

Pacificorp, a subsidiary of Berkshire Hathaway Energy, was removed from the National Mining Association’s membership list web page between February 9, 2016 and March 24, 2016. Pacificorp confirmed to Climate Investigations Center that it is not currently a member of the National Mining Association, but did not provide an explanation for its departure. Pacificorp’s parent company, Warren Buffett’s Berkshire Hathaway Energy, is among the companies that signed the White House American Business Act on Climate Pledge, pledging to invest billions of dollars in renewable energy and “Retire more than 75 percent of our coal-fueled generating capacity in Nevada by 2019.” Pacificorp itself has interests in two coal mines in Wyoming and Colorado, and in 2015 idled a third coal mine in Utah.

SKF

SKF, a manufacturing company based in Sweden, was removed from the National Mining Association’s membership list web page between December 5, 2015 and January 22, 2016. SKF said that it would immediately end its membership in the National Mining Association on December 9, 2015 during the Paris climate summit, according to Swedish public broadcasting SVT, after it was made aware of NMA’s lobbying against US climate policies.

Volvo

Volvo Construction Equipment North America Inc., a subsidiary of Volvo Group based in Sweden, was removed from the National Mining Association’s membership list web page between December 5, 2015and January 22, 2016. Volvo said that it would immediately end its membership in the National Mining Association on December 9, 2015 during the Paris climate summit, and called NMA’s anti-climate policy lobbying “crazy,” according to Swedish public broadcasting SVT. Volvo confirmed its departure from NMA in an email to Greenpeace on December 10, stating: “I can confirm that Volvo is leaving NMA. We do not share the NMA’s view on climate change nor their opinion about the politics on climate change driven by American policy.”

Wells Fargo

Wells Fargo Insurance Services, a subsidiary of Wells Fargo, was removed from the National Mining Association’s membership list web page between June 25, 2014 and February 15, 2015. Wells Fargo confirmed to Climate Investigations Center that it is not currently a member of the National Mining Association, but did not provide an explanation for its departure.

Zurich

Zurich, a major global insurance company based in Switzerland, was removed from the National Mining Association’s membership list web page between June 25, 2014 and February 15, 2015. Zurich responded to Climate Investigations Center to explain that “Zurich ended its membership with the National Mining Association in 2013. Cancelling the membership was a cost cutting measure.” Zurich also pointed to its climate change policy.

Five other major companies have also been removed from NMA’s membership list

In addition to the companies that confirmed their departure from NMA, five other major companies have been removed from NMA’s membership list web page over the last two years: KPMG, Wood Mackenzie, Michelin, CSX, and Norfolk Southern. These companies did not provide a response to Climate Investigations Center’s survey to confirm whether they had ended their membership with the National Mining Association, or provide an explanation.

KPMG

KPMG, a major global professional services company based in the Netherlands, did not confirm whether it had ended its membership with the National Mining Association, or provide an explanation to Climate Investigations Center. Screenshots show that KPMG was removed from NMA’s membership list web page between

February 9, 2016: and March 24, 2016:

Wood Mackenzie

Wood Mackenzie, a global energy and mining consultancy based in the United Kingdom, did not confirm whether it had ended its membership with the National Mining Association, or provide an explanation to Climate Investigations Center. Screenshots show that Wood Mackenzie was removed from NMA’s membership list web page between

March 24, 2016: and April 14, 2016:

Michelin

Michelin, a global tire manufacturer based in France, did not confirm whether it had ended its membership with the National Mining Association, or provide an explanation to Climate Investigations Center. Screenshots show that Michelin North America, a subsidiary of Michelin, was removed from NMA’s membership list web page between

April 26, 2015: and July 17, 2015:

CSX

CSX, a major railroad based in Florida, did not confirm whether it had ended its membership with the National Mining Association, or provide an explanation to Climate Investigations Center. Screenshots show that CSX was removed from NMA’s membership list web page between

June 25, 2014: and February 15, 2015:

Norfolk Southern

Norfolk Southern, a major railroad based in Virginia, did not confirm whether it had ended its membership with the National Mining Association, or provide an explanation to Climate Investigations Center. Screenshots show that Norfolk Southern was removed from NMA’s membership list web page between

January 5, 2016: and January 22, 2016:

Some companies that publicize their support for climate policies remain members of the National Mining Association, despite the coal lobby group’s ongoing efforts against the Clean Power Plan. For example, while KPMG was removed from NMA’s membership list web page in early 2016, other major global consulting firms remain listed, including PricewaterhouseCoopers and Ernst & Young. PricewaterhouseCoopers is among the companies that signed the White House American Business Act on Climate Pledge, and its chairman signed an open letter to world leaders urging “governments to set science-based global and national targets for the reduction of GHG emissions” and committing that the companies will “act as ambassadors for climate action.”

PricewaterhouseCoopers

PricewaterhouseCoopers responded to Climate Investigations Center’s questions about its membership in the NMA:

Like many other businesses, our US firm is a member of trade associations including the National Mining Association to share our research and analysis to stimulate discussion and debate, and to connect with other companies in specific sectors. We remain strictly independent, and are not involved in the decisions or representations this or any other association makes.

Ernst & Young

Ernst & Young did not provide an explanation for its NMA membership.

Siemens

Siemens and Schneider Electric also signed the White House American Business Act on Climate Pledge, as well as the open letter to world leaders urging climate action – yet both also remain listed as NMA members. Siemens responded to Climate Investigations Center’s questions about its membership in the NMA:

Many associations represent a large number of companies from across many different sectors. In their work, they take positions on a highly diverse range of topics. In doing so, deviations in interests can arise in individual cases as is the case with our membership in the National Mining Association. Siemens routinely advocates, among other issues, for policies that encourage the use of renewables and energy efficiency through financing tools and utilization of performance contracting to reduce greenhouse-gas emissions. Siemens has pledged that its own operations will be Carbon Neutral by 2030. Siemens does not support the National Mining Association’s opposition to the Clean Power Plan and we will continue our support and our pledge made to the White House on Climate Protection.

Schneider Electric

Schneider Electric did not provide an explanation for its NMA membership.

PricewaterhouseCoopers, Ernst & Young, Siemens and Schneider Electric are also members of the World Business Council on Sustainable Development, which states that companies should “Strive for consistency in their advocacy” as a condition of membership.

General Electric

General Electric also signed the White House American Business Act on Climate Pledge, yet its subsidiary GE Mining remains a member of the National Mining Association. In contrast, GE confirmed to Climate Investigations Center that it is no longer a member of ACCCE, as noted above, and also ended its membership with the World Coal Association on October 1, 2014 (more details about World Coal Association membership changes in the section below). GE did not provide an explanation for its departure from ACCCE and the World Coal Association, but did respond to Climate Investigations Center’s questions about its NMA membership:

We belong to a broad range of associations and organizations. GE believes that business has an important role to play in promoting technology solutions that balance the need to decrease environmental impact, increase efficiency and spur economic growth around the world.

The London-based World Coal Association (WCA) is the global lobby group for the coal industry, and its membership includes coal mining companies as well as national coal lobby groups such as the National Mining Association. WCA publishes changes to its membership in its annual directors reports, so Climate Investigations Center’s survey requested an explanation for five major companies that were listed by the World Coal Association as “lapsed members” in recent years.

The WCA records also include the date of each company’s lapsed membership, which provide context for some companies that did not confirm to Climate Investigations Center whether or when they left NMA or ACCCE, including bankrupt Arch Coal.

Arch Coal ended its membership in the World Coal Association on November 9, 2015, according to the World Coal Association’s Directors Report for the year ended September 30, 2015. Although Arch Coal did not respond to Climate Investigations Center to explain why it ended its membership with the World Coal Association, November 9, 2015 was also the day that Arch Coal reported in SEC filings that it could soon file for bankruptcy.

Alpha Natural Resources ended its membership in the World Coal Association on August 3, 2015, according to the World Coal Association’s Directors Report for the year ended September 30, 2015. Although Alpha Natural Resources did not respond to Climate Investigations Center to explain why it ended its membership with the World Coal Association, August 3, 2015 was also the day that Alpha Natural Resources filed for bankruptcy.

The timing of Arch Coal’s and Alpha Natural Resources’ lapsed WCA memberships suggests that both coal mining companies may have left the World Coal Association because of their bankruptcies, as the companies moved into a period when their spending and other activities would come under increased review during the bankruptcy process. Arch Coal’s absence from ACCCE’s membership list web page may also be tied to its bankruptcy, since the time frame in which it was removed, between September 24, 2015 and March 12, 2016, overlaps with its bankruptcy warnings and departure from the World Coal Association on November 9, 2015.

Yet there are notable differences in other bankrupt coal mining companies’ memberships in coal lobby groups. For example, despite filing for bankruptcy on April 13, 2016, Peabody Energy remains listed as a WCA member, as well as a member of NMA and ACCCE. Arch Coal remains listed as a member of the NMA, despite its lapsed WCA membership and removal from ACCCE’s membership list web page. Alpha Natural Resources also remains listed as an ACCCE and NMA member, and its CEO Kevin Crutchfield was elected chairman of NMA’s board of directors for 2016.

Consol Energy and Total S.A., a global oil and gas company based in France, both ended their memberships in the World Coal Association on October 1, 2013, according to the World Coal Association’s Directors Report for the year ended September 30, 2014. Consol Energy did not respond to Climate Investigations Center to explain why it ended its membership with the World Coal Association, but as noted earlier, Consol has largely shifted away from coal mining toward natural gas extraction, and was also removed from ACCCE’s membership list web page between September 24, 2015 and March 12, 2016.

Total S.A. confirmed to Climate Investigations Center that it departed the World Coal Association and said that it “can be explained by the fact that we decided last year to exit the coal business. We ceased our coal production following the sale of our affiliate Total Coal South Africa in August 2015 and we will be withdrawing from coal marketing by the end of 2016.” Total also pointed to comments by its CEO Patrick Pouyanné:

It was a matter of both consistent strategy and our credibility. Faced with the issue of climate change, Total is committed to promoting the use of natural gas, the cleanest fossil fuel, especially compared to coal, which emits twice as much greenhouse gas when used to generate power. We cannot claim to be providing solutions to climate change while continuing to produce or market coal, the fossil fuel that emits more greenhouse gas than any other.

Along with Chevron’s departure from the National Mining Association because it “no longer has active coal or mineral mining operations,” these lost members highlight one of the most significant examples of the growing isolation of the coal mining industry: increasing competition with major oil companies as they focus on natural gas. That competition for market share means that the oil and gas industry is increasingly at odds with the goals of the coal mining lobby.

Although the coal mining lobby is increasingly isolated from the utility, oil and gas, and other industries, those industry sectors of course remain actively opposed to a variety of climate policy efforts. But utilities and oil and gas companies face more direct and immediate challenges of their own, and that is reflected in their lobbying efforts.

Oil and gas companies face intensifying opposition from communities impacted by the expansion of fracking, pipelines, LNG exports, refineries, and other industry infrastructure and proposals. In response, oil and gas companies are fighting against state and local restrictions, along with other policy efforts like requirements to use safer technology a oil refineries and reduce methane pollutionthroughout their operations.

Utilities, mining companies, and oil and gas companies also face growing questions from investors about the viability of their business strategies in a carbon constrained world. In response, oil and gas companies have sought to position themselves as part of the solution, helping to transition away from coal. For example, Statoil states that “a faster transition from coal to gas is essential in realising fast emission reductions.” ExxonMobil’s response to concerns about carbon asset risk argues that efforts to reduce greenhouse gas emissions “will also likely result in dramatic global growth in natural gas consumption at the expense of other forms of energy, such as coal.”

Investors have also specifically challenged companies on their coal use, with the Norwegian Government Pension Fund announcement in June 2015 that it would divest from utilities and mining companies that “base 30% or more of their activities on coal, and/or derive 30% of their revenues from coal.”

Perhaps most importantly, both the utility and oil and gas industries face new competitors and challenges to their business models. Utilities face disruption by increasingly affordable distributed renewable energy. In response, some utility companies and their principal lobby group, the Edison Electric Institute, are pushing to add new fees and restrictions on rooftop solar power. Efficiency improvements have helped reduce electricity demand in the US, and increased adoption of electric vehicles could also challenge future oil demand. At the same time, utilities are working “to accelerate the widespread adoption of EVs” in the hopes of a new driver of electricity demand growth, representing another potential division between industry sectors.

These divisions suggest that the increasing isolation of the coal mining lobby is part of a broader fracturing of corporate lobbying on climate policies, a major change from past corporate efforts such as the Global Climate Coalition, an alliance of oil, coal, utilities, automakers, and other business interests that opposed global climate efforts in the 1990s. As the challenges to legacy energy industries proliferate, we can expect more division and disagreement between the coal, utility, and oil and gas industries.